July 2021 Newsletter

This spring, the Kansas Legislature passed House Bill 2064, which was signed into law by Governor Kelly on May 3. House Bill 2064 created the Kansas promise scholarship act to provide post-secondary educational scholarships for certain two-year associate degree programs, career and technical education certificates and other stand-alone programs. Individuals who meet the qualifications for the program are eligible for scholarships that cover the costs of tuition, fees, books, and supplies.

One of the goals of this program is to encourage Kansans to stay in the state after receiving their education. As data show, many of our graduates leave Kansas as soon as their schooling is complete. This scholarship requires that students who accept the funds live and work in Kansas for two years once their education is complete. Should a student wish to earn a Bachelor's Degree beyond their Associate's, they can do that. However, if that four-year program occurs at a university out of state, those students will still be required to return to Kansas after graduation in order to fulfill their two-year work requirement.

Details of the program are described here: Kansas Promise Scholarship Fund Specifics:

- Last dollar scholarship which applies after all other federal aid and any outside scholarships are subtracted from the student’s bill.

- Pays for tuition, fees, books, and supplies for up to an associate degree. Allows the student to attend community college without cost except for any room and board costs they may incur.

- $10,000,000 across the state available and has been already appropriated for FY 22 and FY 23 to fund the program.

Eligible Students/ Income limits:

(Student can attend full or part-time [At least 6 hours per semester] and complete program of study within 30 months.)

- A Kansas resident who has graduated from an accredited Kansas public or a private secondary school (or Kansas homeschool) within the preceding 12 months.

- A Kansas resident who has been in KS three or more consecutive years and who is at least 21 years of age or older.

- A dependent child of military servicemember permanently stationed in another state & graduated in the last 12 months.

- All eligible students must have family household income equal to $100,000 or less for a family of two, $150,000 or less for a family of three and, for household sizes above three, a household income that is equal to or less than the family of three amount plus $4,800 for each additional family member. If scholarship moneys remain in the Kansas promise scholarship program fund during the award year after awarding all other scholarships pursuant to this section, Kansas promise scholarships may be awarded to eligible students whose family household income exceeds such amounts.

Eligible Areas of Study:

- Information technology and security.

- Mental and physical healthcare.

- Advanced manufacturing and building trades.

- Early childhood education and development.

- One additional program identified by each institution. See below links for the eligible programs at each community college.

Student obligations for accepting a Kansas Promise Scholarship:

- Complete the FASFA.

- Complete the Kansas Promise Scholarship Application

- Enter into an agreement to live AND work in Kansas for two years post certificate or degree completion. Can delay the obligation if pursuing a bachelor’s degree. If the student fails to fulfil scholarship requirements the amount of the scholarship must be paid back plus interest.

- Maintain satisfactory academic progress (SAP) and complete program of study within 30 months of first receiving the Kansas Promise Scholarship.

Seward County Community College Approved Promise Act Eligible Programs

Career and Technical Education Programs

Drafting and Design Technology

Corrosion Technology

Process Technology

Heating, Ventilation, Air Conditioning & Refrigeration

Machine Technology

Welding Technology

EMT: Basic

Respiratory Therapy

Surgical Technology

Medical Laboratory Technology

Phlebotomy

Certified Medication Aide

Nursing (ADN) (Ottawa University)

Nursing (LPN)

Certified Nurses Aide

Computer Support Technician

Grain Elevator Operator

Associates Degree Programs requiring less than 68 credit hours for completion.

AA in Elementary Education (K-Step up KSU)

AS in Elementary Education (K-Step up KSU)

For more information or to apply, visit KACCT.org

Board of County Commissioners Approve Rural Opportunity Zone (ROZ) Resolution

Businesses and entities in Seward County are now equipped with more tools to recruit and retrain talented employees. With the commissioners' vote at the June 21 meeting, Seward County officially became a ROZ county, which opens the door for any business, organization, or government entity within Seward County to offer two new benefits for new hires relocating to the county.

1. Student Loan Repayment Assistance

- Administered By Kansas Department of Commerce (KDC)

- Partners with Counties, Cities, Employers, and Foundations

- Provides up to $15,000 in Student Loan Repayment Assistance over 5 years

2. 100 % State Income Tax Credit

- Administered By Kansas Department of Revenue (KDOR)

- Filed with state taxes; only eligible with online filing on KDOR website

Employers who wish to offer the Student Loan Repayment Assistance can dedicate a portion of their budget to the funds, which will be matched by the State of Kansas. For example, if an employee qualifies for the full $15,000 forgiveness, the employer would pay $1,500 towards that forgiveness each year for five years. The State of Kansas would match those payments each year. There are specific requirements for this program including when an individual moves to Seward County, where he or she lived before, and what degree he or she received.

The State Income Tax Credit is available for new employees and does not require any cash expenditures on behalf of the employer. As with the student loan program, new employees must meet the residency requirements. Additionally, the timeline for income tax forgiveness begins January 1 of each year, and an employee must live in the county for the entire year in order to receive the credit. The five-year program would begin January 1, 2022 for anyone hired between now and the end of the year.

Community Foundations and philanthropic organizations can pledge funds to this program as well. These can then be structured as a general pool for anyone who moves to Seward County for work and meets the specific requirements of the program.

If you would like to learn more about this program or are interested in participating as an employer or entity, please contact Eli Svaty at the Seward County Development Corporation. More information can also be found at the Kansas Department of Commerce webpage:

https://www.kansascommerce.gov/program/taxes-and-financing/roz/

Southwest Region Surpasses $1 Billion in Capital Investment in 2021

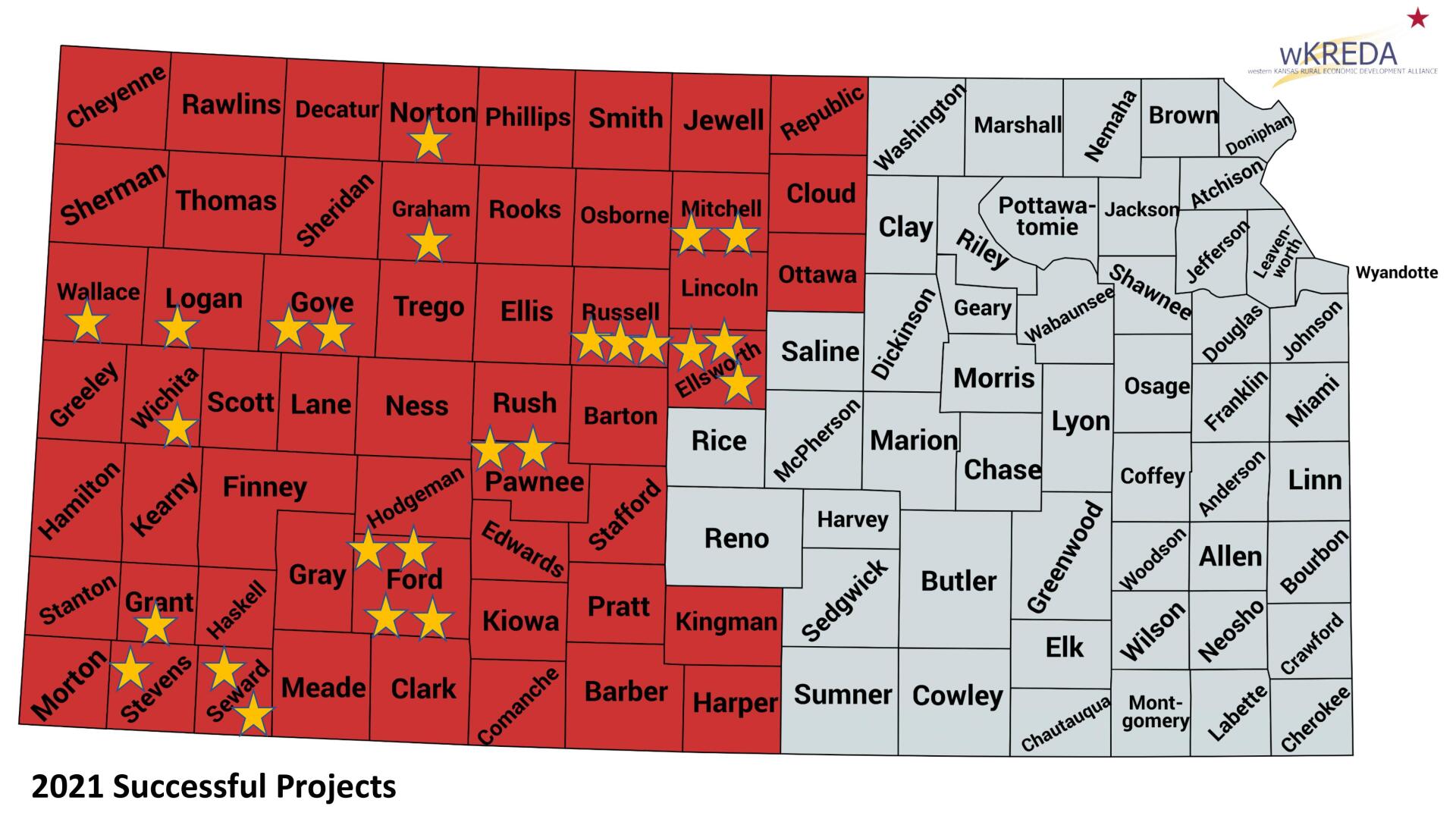

The Western Kansas Rural Economic Development Alliance (WKREDA) was formed nearly three decades ago, and since its founding, has worked to improve the economic vitality of the region. Now serving fifty-five counties in central and western Kansas, the organization is comprised of economic development professionals, community development professionals, and resource partners from across the region. We meet quarterly, this time in Greensburg, to tour local development projects, share best practices, and plan regional strategies. At the June conference, Jonathan Clayton (Southwest In-State Business Development Project Manager & Certified Sites Program Manager) shared the economic development progress report for the first half of 2021. Below are highlights from the presentation.

The "Successful Projects" stars on the main map represent new developments or expansion projects that utilized Department of Commerce programs and/or incentives. We are significantly ahead of previous years in terms of number of projects and capital investment, and we are only halfway through the year. We have already surpassed $1 Billion in new capital investment through these projects. Additionally, commerce--and the rest of us--are pleased with the distribution of projects throughout the WKREDA region. Comparisons are also available for capital investment, job creation, and regional comparisons.

The stars in Seward County represent the investments being made by National Beef Packing and Conestoga Energy Partners. We are grateful to the commitment these corporations have made and continue to make to the betterment of our county and our region. New industry growth is great, but it's even more exciting to see an existing company succeed and grow.

E-Community EMPOWER Loan Pilot Program Makes Loans up to $15,000 Available for Local Minority-Owned Businesses and Organizations

The Seward County Development Corporation is excited to announce the availability of the EMPOWER Loan program for minority-owned businesses and organizations in Seward County. This new loan program is funded by Network Kansas and its Kansas Community Impact Fund program and is overseen by our local Entrepreneurship or E-Community Board.

Minority-owned businesses in Seward County can apply for loans up to $15,000. These funds can be used for business start-up, business expansion, or business acquisition. Minority-led organizations are also eligible to apply to this new funding program. Loans will have a 4% interest rate with a term of 48 months. All applications will be reviewed by the Seward County Development Corporation's E-Community Board and financing/repayment will be overseen by Network Kansas.

The goal of the program is to provide capital for a demographic that has historically relied on personal cash or alternative funding options to launch or expand a business. We have strong financial institutions in our region, and we are confident that the business owner's experience with this EMPOWER Loan program will give them the confidence to seek traditional funding through our local banks in the future.

If you are small business owner who qualifies, or you know someone who would, look for more information on the Seward County Development Corporation's website www.swks.org or contact Eli Svaty at 620-604-5136.

City of Liberal Economic Development News

Community Improvement Districts

The City of Liberal has had several Community Improvement Districts (CID) formed over the last few years. Some areas utilizing this program to develop their projects are I-Hop, Old Chicago and Comfort Inn locations, along with east part of Liberal Plaza and Southgate Mall. A public hearing for the area of Liberal Plaza will be held this month to designate that section as a CID.

In 2009, the Kansas Legislature enacted the Community Improvement District Act, which is codified at K.S.A. 12-6a26 et seq. (the “CID Act”), pursuant to which municipalities may create districts in which certain special taxes imposed and the revenue used to fund certain public and private improvements and the payment of certain ongoing operating costs within the geographic bounds of the specified district. The creation of a CID is a useful tool of economic development that is used all over the country in that it can help facilitate beneficial private development and redevelopment without negatively impacting the tax base of the approving municipality. It is the policy of the City of Liberal to utilize the provisions of the CID Act to assist private developers by providing financing for commercial, industrial and mixed-use projects that meet the local eligibility requirements. The CID can exist for a maximum of 22 years.

The CID will attract development which would enhance the economic climate of the City or otherwise benefit the City or its residents. The CID will also result in the construction of public or private property improvements and infrastructure that would otherwise not be financially feasible.

The City acts as the pass- through entity for the proposed CID project. No taxpayer dollars are used! The developer has a process they need to go through in order to apply. They have to petition the landowners within the CID District, petition the City Commission to form a CID District, how they will finance the project and proposed method of financing (pay-as-you-go), and their source of funding. Most developers will use a special sales tax of up to 2% on all taxable sales within the district. Upon the creation of a CID by the City Commission, revenue generated by the funding source is available to pay for eligible improvements and costs through the use of a pay-as-you-go dedicated account.

For more information or questions contact the City of Liberal Economic Development Department, Cindy Wallace, Director at (620) 626-2256 or email cindy.wallace@cityofliberal.org.

Join Our Email List

If you were lucky enough to be forwarded this newsletter from a friend, we're happy to help you join the list and receive your own copy. Please use this link to receive our monthly newsletter and stay informed about programs, grants, and opportunities. Plus, businesses on our list can be the featured Local Business Spotlight!